Financial planning is the process of creating a roadmap to achieve your financial goals. It involves evaluating your current financial status, setting achievable goals, and developing strategies to reach those goals.

While many people associate financial planning with retirement, it is much more than that.

It can help you achieve short-term and long-term financial stability, provide peace of mind, and help you build a legacy for future generations.

Jump to Section

Creating a Roadmap to Your Financial Goals

One of the primary purposes of financial planning is to create a roadmap to achieve your financial goals.

This involves evaluating your current financial status, setting achievable goals, and developing strategies to reach those goals.

By creating a plan, you can identify areas where you need to make changes and develop a strategy to achieve your goals.

Some tips for creating a roadmap to your financial goals include:

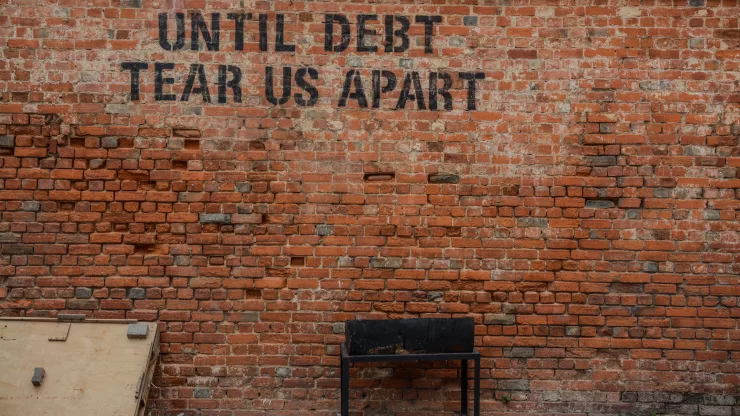

- Identify your goals: What do you want to achieve financially? Do you want to pay off debt, save for a down payment on a house, or start investing for retirement?

- Evaluate your current financial status: What is your current income, expenses, and debt? How much do you have saved?

- Develop a strategy: Once you have identified your goals and evaluated your current financial status, develop a strategy to achieve your goals. This may involve paying off debt, increasing your income, or investing in the stock market.

Achieving Financial Freedom Through Planning

Financial planning can help you achieve financial freedom.

Financial freedom means having enough money to cover your expenses and live the life you want without having to worry about money.

It involves building wealth, creating passive income streams, and having a plan for the future.

Some tips for achieving financial freedom through planning include:

- Set financial goals: Identify your financial goals and create a plan to achieve them.

- Live within your means: Spend less than you earn and avoid debt.

- Build wealth: Invest in stocks, real estate, or other assets that appreciate in value.

- Create passive income streams: Consider starting a business or investing in rental properties.

- Have a plan for the future: Create a plan for retirement and estate planning.

The Psychological Benefits of Financial Planning

In addition to the financial benefits, financial planning can also provide psychological benefits.

Financial stress can take a toll on your mental health, and having a plan in place can alleviate some of that stress.

Financial planning can also provide a sense of control over your finances, which can lead to increased confidence and self-esteem.

Some psychological benefits of financial planning include:

- Reduced financial stress: Knowing you have a plan in place can reduce financial stress and anxiety.

- Increased confidence: Having a plan in place can provide a sense of control over your finances, which can lead to increased confidence and self-esteem.

- Improved relationships: Financial planning can improve your relationships with your spouse, family, and friends by reducing financial stress and improving communication about money.

The Importance of Regular Financial Check-Ins

Financial planning is not a one-time event. It is an ongoing process that requires regular check-ins to ensure you are on track to achieve your goals.

Regular check-ins can help you identify areas where you need to make adjustments and ensure you are staying on track to achieve your goals.

Some tips for regular financial check-ins include:

- Schedule regular check-ins: Set a specific time each month or quarter to review your finances.

- Evaluate your progress: Review your progress toward your financial goals and make any necessary adjustments.

- Identify areas for improvement: Identify areas where you need to make changes to achieve your goals.

Building a Legacy Through Strategic Planning

Financial planning can also help you build a legacy for future generations. By creating a plan for your finances, you can ensure that your assets are distributed according to your wishes and that your family is taken care of after you are gone.

Some tips for building a legacy through strategic planning include:

- Create a will: A will ensures that your assets are distributed according to your wishes.

- Consider estate planning: Estate planning can help you reduce taxes and ensure that your assets are distributed efficiently.

- Involve your family: Communicate with your family about your financial plan and involve them in the decision-making process.

FAQ

How can I get started with financial planning?

To get started with financial planning, identify your financial goals and evaluate your current financial status. Develop a strategy to achieve your goals and regularly check in to ensure you are on track.

What are some common financial planning mistakes?

Some common financial planning mistakes include not having a plan in place, not regularly checking in on your finances, and spending more than you earn.

How often should I review my financial plan?

It is recommended that you review your financial plan at least once a year. However, you may need to review it more frequently if there are major changes in your life, such as a job loss or major purchase.

With a deep passion for personal development, Ben has dedicated his career to inspiring and guiding others on their journey towards self-improvement.

His love for learning and sharing knowledge about personal growth strategies, mindfulness, and goal-setting principles has led him to create My Virtual Life Coach.

Contact Ben at [email protected] for assistance.